Cryptocurrencies have been trending upwards in price over the last few weeks, but in certain countries around the world digital assets have become far more valuable. For instance, in Argentina, the nation’s sovereign currency has lost considerable value and cryptocurrencies like BTC are seeing all-time price highs. The surge in value is not just taking place in Argentina as a few other countries suffering from hyperinflation are seeing significant demand as well.

Lots of Crypto Demand Stems from Countries Experiencing High Inflation and Currency Devaluation

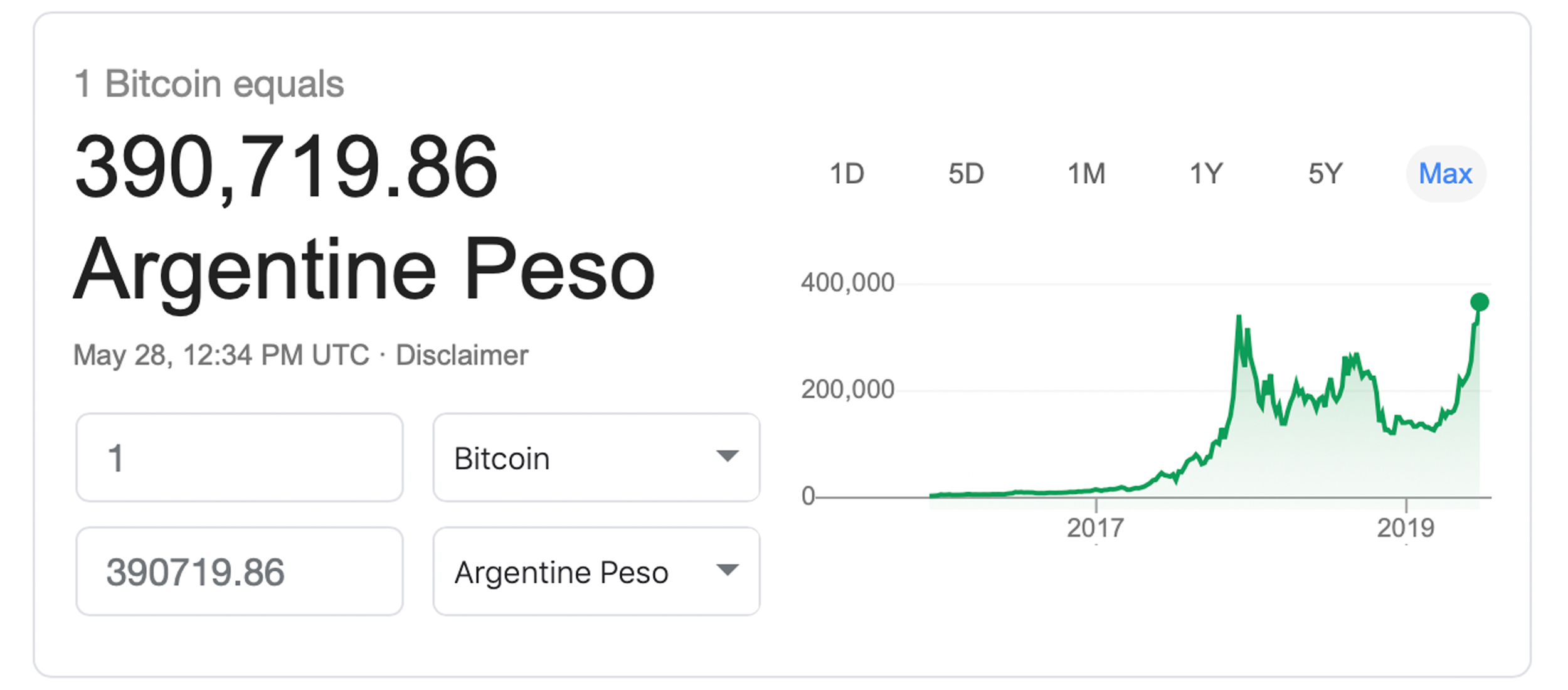

Over the last week, digital currency supporters have noticed that the price of bitcoin core (BTC) and a few other popular assets have been seeing higher price gains in some markets compared with the rest of the world. The trend has been seen in countries suffering from economic distress and hyperinflation, an accelerated version of traditional inflation. Essentially the state’s currency begins to erode extremely fast and the prices of goods like food and medical supplies increase. Due to this factor, the region’s citizens usually switch to more stable foreign currencies in order to hedge against rapid inflation. Crypto supporters have been noticing this happen with digital assets and recently people have observed the high price of BTC in Argentina. Against the Argentine peso, bitcoin core’s value has spiked considerably and is even surpassing the all-time high in 2017.

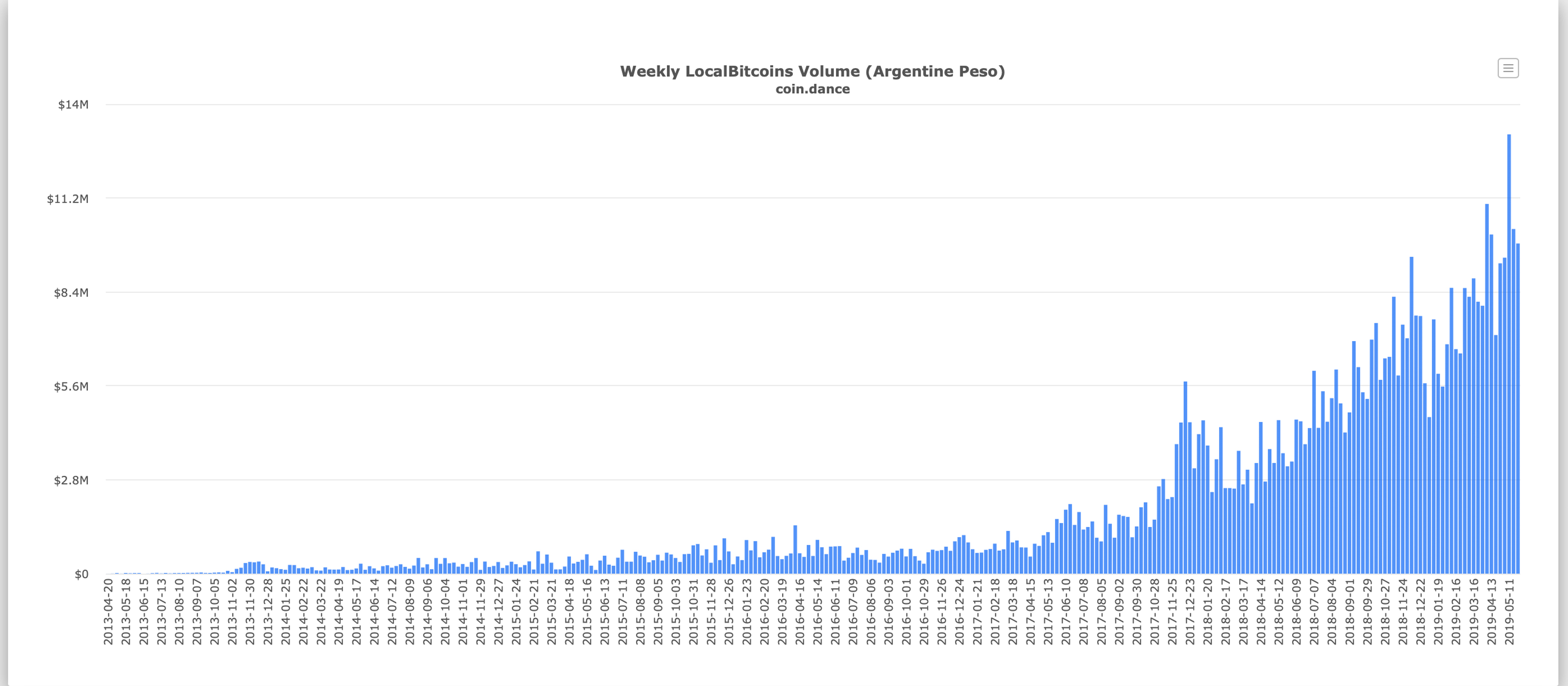

Currently, the price per BTC is 390,719 pesos in Argentina and Localbitcoins trade volumes have also touched an all-time high. During the first week of May, Argentinian Localbitcoins volumes reached $13 million and trading has continued relentlessly. The Argentine peso has seen a massive decline against the U.S. dollar and the economic uncertainties stem from the country’s upcoming change in leadership. However, the same trend is taking place with a few other failing currencies too like the Venezuelan bolivar, Sudanese pound, and Turkish lira. And there are other countries like Colombia, Chile, and Russia that are seeing increased crypto volumes and more demand than usual. Further, places like Argentina and Venezuela are also seeing demand for bitcoin cash (BCH) over the last 30 days.

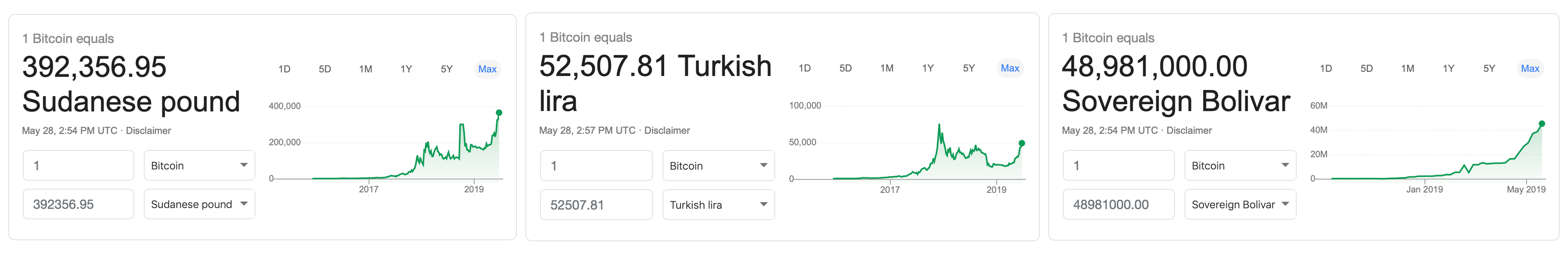

On Localbitcoins, the Turkish lira has seen steady volumes growing on the exchange and prices show that the value of BTC is nearing 2017 highs as well. At press time 1 BTC is around 52,577 Turkish lira and there’s been 500,000 to 750,000 in Localbitcoins volumes over the last few weeks. Throughout 2018 and 2019 the Turkish economy has seen rapid inflation and the lira has seen a decline in value against other currencies. In addition to the lira, the Sudanese pound verses BTC has also been climbing dramatically.

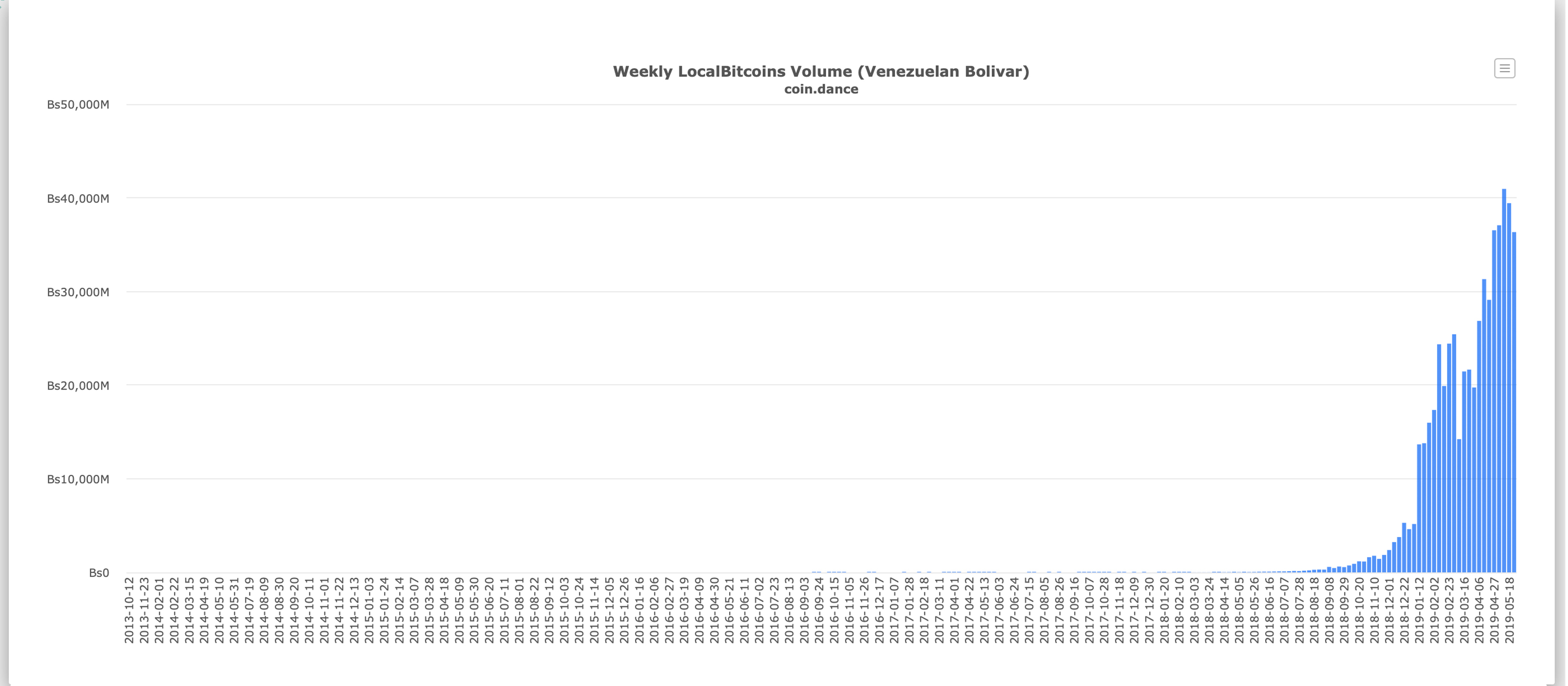

At the time of publication, a single BTC is 393,650 Sudanese pounds and liquidity is extremely low in the region. Venezuela is also in the same circumstances as the country’s inflation rate of 1.30 million percent as of April 2019 has wreaked havoc on the sovereign bolivar. Over the past few weeks of Localbitcoins volume data, the country continues to smash all-time records. According to current exchange rates at press time, 1 BTC is 49,117,302 bolivars. There’s been a lot of focus on Venezuela because the country has the highest inflation rate globally but there are a few other countries that are following similar paths. Alongside BTC, crypto advocates have been promoting BCH heavily in these regions as well, with lots of attention focused on Venezuela’s hardships.

Local.Bitcoin.com Launch and the Bitcoin Cash Venezuela Merchant Initiative

Bitcoin Cash supporters have been in Venezuela promoting the use of the decentralized currency regularly. At Bitcoin.com we recognize the need for people to trade fiat currencies for permissionless cryptocurrencies and that’s why we created Local.Bitcoin.com. People from all around the world can trade bitcoin cash (BCH) with each other in a peer-to-peer fashion when our noncustodial exchange Local BCH launches on June 4, 2019.

Bitcoin cash gives any global citizen the freedom to escape the erratic behavior of centralized fiat currencies. And the low transaction fees that are below one cent highlight how BCH is superior for remittances. In addition to the over-the-counter exchange coming next week, Bitcoin.com has also been pushing merchant adoption with our Bitcoin Cash Venezuela initiative. Our merchant adoption effort in the country aims to help retailers accept a new means of digital exchange and at the same time, escape the bolivar’s devaluation.

The demand for cryptocurrencies has grown quite sizable over the last decade, but in the last few years interest stemming from regions suffering from severe economic hardships has spiked considerably. There is a great need for permissionless digital assets like BCH in countries where the state-issued currencies are becoming worthless, capital controls are imposed, and sanctions from oppressive leaders make economic participation harder. It’s likely at any time global citizens who really need a reliable medium of exchange will flock to digital assets that can provide the means to fulfill their ends. Individuals need alternative forms of money and especially one that works. Interest in a cryptocurrency that can provide permissionless exchange, alongside reliability will surely surpass the speculative bunch of investors begging for institutional types to jump aboard. It is evident that citizens from Argentina, Turkey, Venezuela, and other countries are showing strong demand for permissionless assets and this will only continue to grow.

What do you think about the demand for cryptos in regions where rapid inflation is dominant? Let us know in the comments section below.

Image credits: Shutterstock, Google currency prices, Local.Bitcoin.com, Venezuela.Bitcoin.com, Coin Dance Cash.

Did you know you can also buy Bitcoin Cash online with us? Download your free Bitcoin wallet and head to our Purchase Bitcoin page where you can buy BCH and BTC securely.

The post Countries Suffering From Rapid Inflation Show Significant Demand for Cryptos appeared first on Bitcoin News.