From Stockholm to New York, major global hubs are ditching cash for cards. As contactless payment devices including smartphones and smartwatches proliferate, hard currency is falling out of favor. But for all the convenience that touch payments bring, the cashless transition has major ramifications for the most underserved segments of society.

Also read: Russian Marketplace Allows Users to Sell Items Priced in Cryptocurrency

Cash Is No Longer King

On June 1, 2018, shoppers across the U.K. discovered that their Visa cards had inexplicably stopped working. Queues formed at supermarket checkouts and IOUs were written at gas stations as motorists realized the plastic in their pocket was no longer good. The outage lasted for several hours and caused major disruption, exacerbated by the fact that, as with many western countries, most Brits no longer carry significant amounts of cash. In an era where any purchase, from a cup of coffee to a car, can be purchased with a swipe of an NFC device or by pressing four buttons on a chip and PIN device, cash is no longer in vogue.

On June 1, 2018, shoppers across the U.K. discovered that their Visa cards had inexplicably stopped working. Queues formed at supermarket checkouts and IOUs were written at gas stations as motorists realized the plastic in their pocket was no longer good. The outage lasted for several hours and caused major disruption, exacerbated by the fact that, as with many western countries, most Brits no longer carry significant amounts of cash. In an era where any purchase, from a cup of coffee to a car, can be purchased with a swipe of an NFC device or by pressing four buttons on a chip and PIN device, cash is no longer in vogue.

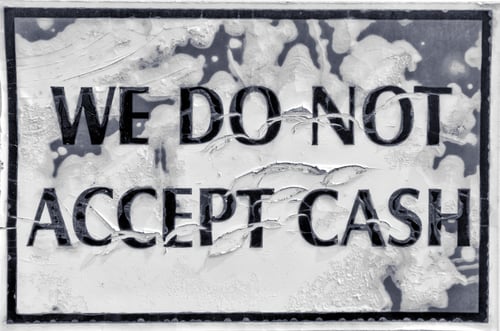

Try to pay in cash at an upmarket boutique or chic brasserie these days and the assistant is likely to glance askance at the wad of notes proffered. Nowhere is this trend more prevalent than in New York, where cash-free establishments are commonplace. Not everyone is enamored with the “cashless revolution” taking place, however. Critics warn it risks creating an underclass of second-rate citizens, excluded by elitist monetary policy. One lawmaker is particularly alarmed by the trend, and his concerns have nothing to do with the risk posed by Visa’s servers shutting down. New York City council member Ritchie J. Torres is seeking to introduce legislation banning cash-free stores on the grounds that they promote racism and elitism.

Credit Cards and the Menace of a Cashless Society

Ostensibly, cashless businesses are all about convenience: the convenience of not having to wait in line while the person in front of you fumbles for the right change, and the convenience for business owners of not having to take the day’s earnings to the bank or worry about being robbed. Even if the intentions behind the cashless movement are honorable, a side effect is to disenfranchise those who are already marginalized and unable to access the credit or high-tech consumer devices necessary to participate. Critics fear that gentrification through cash exclusion will ultimately sweep entire neighborhoods, driving out the poor, minorities and people with bad credit.

“Paper money is a universal currency. We all use it at some point in our lives, and delegitimizing paper money with a card-only policy should be unlawful,” opined Torres. Another danger of sleepwalking into a world in which cash is passé is censoring transactions, freezing out “undesirables,” and sweeping surveillance becoming the norm. Today, the U.S. has the power to wield economic sanctions against nations, entities and individuals it deems enemies of the state.

What happens, in the not-so-distant future, when it can wield this power against individuals on its home soil, preventing them from purchasing so much as a slushie without the say-so of Uncle Sam? Financial censorship isn’t just an American weapon, either — China’s social credit system has induced widespread consternation and condemnation. When coupled with the cashless transition occurring globally, the sort of dystopia envisioned in movies like “Minority Report” doesn’t seem so far-fetched.

Cryptocurrency Is Cash

Cryptocurrencies such as bitcoin are often compared to electronic payment systems such as Visa, particularly in terms of throughput and network effects. In truth, though, bitcoin has much more in common with paper cash than it does with its electronic equivalent. Like dollar bills, bitcoins are fungible, unfreezable and nondiscriminatory. They are worth the same amount in the hands of a pauper as they are in the hands of a prince. No credit history or bank account is required to own either. Cryptocurrency is cash for the 21st century.

Significant efforts are being expended on increasing merchant adoption of P2P cryptocurrencies such as bitcoin cash, while bitcoin core proponents are optimistic that BTC may be suitable for microtransactions again should the much-vaunted Lightning Network ever materialize. Realistically, cryptocurrencies are not going to serve as an egalitarian alternative payment system in cashless stores any time soon. Nevertheless, they serve a vital role as the world distances itself from cash, providing pseudonymous and censorship-resistant money for the masses.

Significant efforts are being expended on increasing merchant adoption of P2P cryptocurrencies such as bitcoin cash, while bitcoin core proponents are optimistic that BTC may be suitable for microtransactions again should the much-vaunted Lightning Network ever materialize. Realistically, cryptocurrencies are not going to serve as an egalitarian alternative payment system in cashless stores any time soon. Nevertheless, they serve a vital role as the world distances itself from cash, providing pseudonymous and censorship-resistant money for the masses.

Do you think cashless businesses are discriminatory? Let us know in the comments section below.

Images courtesy of Shutterstock.

Need to calculate your bitcoin holdings? Check our tools section.

The post A Cashless Society – Utopia or Dystopia? appeared first on Bitcoin News.