There’s a standard market price for milk, speed boats, and even birthday clowns, but the going rate for agency services is a little more of a gray area.

This lack of clear guidance has led every agency leader to ask themselves at some point during their company’s growth: How the heck should I price my services?

HubSpot Research recently conducted a survey of 782 agencies to get a better picture of how they set prices for their offerings. The Agency Pricing & Financials Report offers new benchmark data to help agencies understand how their peers are creating and evaluating price structures, acquiring new business, and selling services.

To enable you to make more informed and scalable decisions about your own pricing model at every stage of growth, we’ve pulled out four charts from the research that best explain how agencies are approaching their prices.

You can take a look at the full report here, or read on to check out the pricing charts.

How Agencies Price Their Services

1) The CEO is the key decision maker for setting prices, but other departments can offer valuable insight.

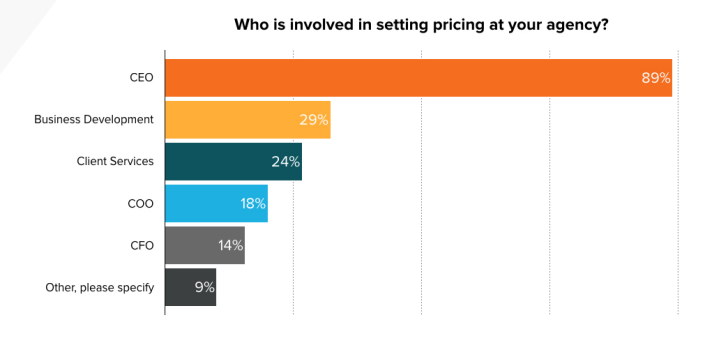

When it comes to setting service prices, the agency CEO is most likely to be the one calling the shots. 89% of survey participants said that their CEO was the biggest decision maker for pricing. However, business development and client services departments are steadily increasing their influence. And they have a lot to offer.

These departments (or individuals depending on the size of your agency) have more direct contact with prospects and clients than anyone else in the business. They’re tuned in to the clients’ expectations and needs, and probably have a good idea of what customers are willing to pay to get problems solved. They likely also have some valuable insights into your agency’s biggest competition and what they’re charging.

Even if you work at a small shop where the CEO takes charge of every infrastructure decision, it will pay off to include business development and client services in pricing discussions.

2) Most agencies rely on a retainer or fixed fee pricing model, but they should always be willing to reevaluate.

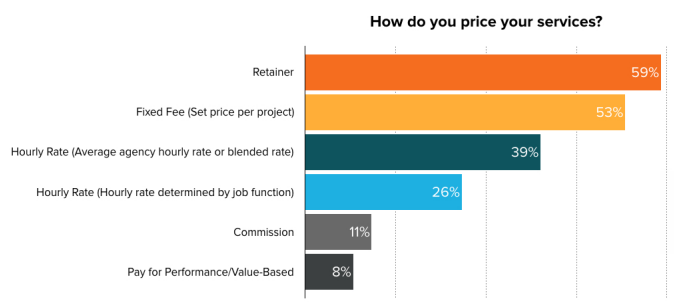

Retainer-based pricing models can offer agencies increased security by ensuring they’re paid up front for their hefty investment of time and manpower. Keeping clients on retainers also alleviates some of the stress and desperation associated with constantly seeking new business opportunities, since you already have a steady and reliable source of income. With these clear benefits, it’s not surprising that the majority of survey participants identified retainers as the most commonly used pricing model.

In order to avoid messy reevaluations and potential scope creep down the line, it’s vital that agencies clearly and firmly define the project’s scope at the outset. This way, there are clear expectations on both sides about the project’s timeline, budget, what the work entails.

In the event that a project does evolve or grow to the point where the agency is in danger of over-servicing, there should be a process in place to re-negotiate terms with the client.

So is there a one perfect pricing model? Not quite. Despite the popularity of the retainer and fixed fee models, agencies should fully explore their pricing model options and figure out what works best for them and their clients.

3) Agencies that want to increase their retainer pricing should consider shifting towards a value-based retainer model.

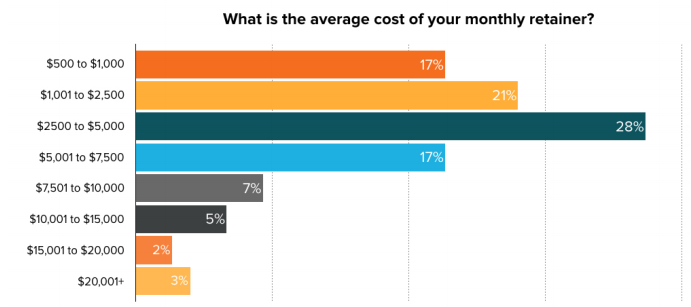

Of the agencies surveyed that use a retainer-based pricing model, the average retainer price varied, with most agencies falling in the $2,500 to $5,000 range. Retainer prices are traditionally based on a client’s overall budget, the anticipated scope of services you’ll be performing, and how many hours you’re planning to devote to the client.

While these factors are important to consider when devising the initial estimate, agencies looking to increase their retainer prices should consider transitioning to more a value-based retainer pricing model.

Instead of selling your services as: “You pay us X and we give you Y and Z,” try to shift the expectation to “You pay X for the ability to work with us for a month.” This will increase the perceived value of your services and give you the necessary flexibility to focus entirely on bringing the client results.

4) Agencies with a performance-based pricing model should consider using more diverse metrics to measure value.

According to the report, only 8% of agencies consider their pricing model to be completely performance or value based. So what does a value-based model technically entail? It prices an agency’s services based on the measurable value the agency ends up delivering to the client. How that value is measured is usually agreed upon in advance with the client.

Of the agencies surveyed, those using a completely value-based model said leads is the metric most often used to evaluate their performance. But is counting leads alone really the best way to measure the success of a project or campaign?

Probably not. While leads are an easily measured KPI, they don’t always represent the complete picture of success. Think about it: If a campaign brings in 1,000 new leads, but none of those leads are actually qualified, did the campaign really provide value?

Agencies relying on a performance-based pricing system should sit down with individual clients and decide what’s really important to them, and devise a pricing system based on their unique KPIs.